Navigating the vibrant property landscape of Egypt’s Red Sea can feel like charting a course without a map, especially when reliable data is scarce and future trends seem uncertain. Whether you are an expatriate searching for the perfect apartment for rent or an investor evaluating the market’s potential, making a decision with confidence is paramount. The allure of premier destinations like El Gouna and Soma Bay is undeniable, but success in this dynamic environment requires more than just admiration—it demands strategic insight and dependable expertise.

This comprehensive 2026 market overview is designed to be your definitive guide. We will demystify the complexities of the rental sector, providing you with expert analysis on rental price trajectories, the most sought-after property features, and emerging investment opportunities. Consider this your roadmap to navigating the Red Sea rental market with the assurance and clarity that only a trusted partner can provide. Your next move, whether as a tenant or an investor, begins here.

The State of the Red Sea Rental Market Heading into 2026

As we approach 2026, Egypt’s Red Sea coast, particularly in premier destinations like El Gouna, is undergoing a significant transformation. Once viewed primarily as a holiday hotspot, the region is now solidifying its status as a top-tier global destination for lifestyle renting and long-term residency. This evolution is driven by a confluence of powerful economic and social trends, creating a dynamic and sophisticated rental market for prospective tenants and investors alike.

Key Drivers of Rental Demand

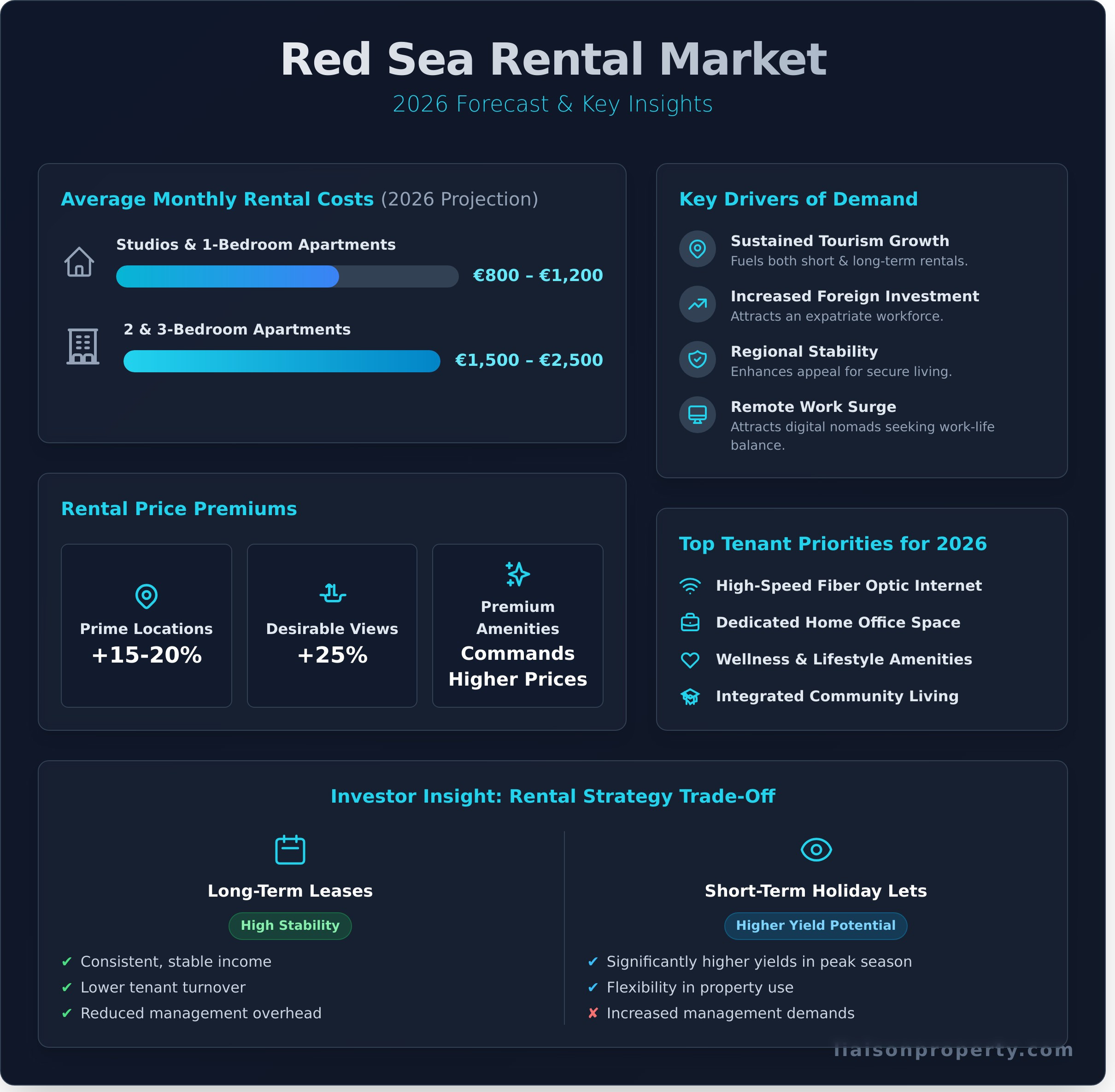

The robust demand for a premium apartment for rent is being propelled by several key factors. A post-pandemic surge in remote work has attracted a new wave of digital nomads and professionals seeking an unparalleled work-life balance amidst stunning natural beauty. This is complemented by:

- Sustained Tourism Growth: A resilient tourism sector fuels both short-term holiday lets and long-term rental demand from industry professionals.

- Increased Foreign Investment: Significant international investment in infrastructure and luxury developments stimulates the local economy and attracts an expatriate workforce.

- Regional Stability: Egypt’s position as a stable and welcoming country enhances its appeal for foreigners seeking a secure and culturally rich environment to call home.

Supply vs. Demand Dynamics

While numerous new residential projects are slated for completion, the influx of supply is being met with equally strong, if not stronger, demand. This balance suggests the market will remain competitive, particularly in the premium segment where quality and location are paramount. The development of integrated, resort-style communities continues to elevate the standard of living, increasing the appeal of high-end rentals. Consequently, occupancy rates in sought-after communities are projected to remain robust, reflecting sustained confidence in the region’s long-term value and desirability.

Impact of Macro-Economic Trends

Global shifts are profoundly shaping rental preferences along the Red Sea. International travel trends emphasizing wellness, sustainability, and authentic experiences are influencing the types of properties in demand. For many international tenants, favorable currency exchange rates have enhanced affordability, making a premium lifestyle more accessible. Furthermore, proactive government initiatives aimed at encouraging foreign investment and simplifying residency are positively shaping the Red Sea Governorate’s economic landscape, creating a seamless entry for those looking to invest or reside in this vibrant region.

Rental Price Forecasts and Key Benchmarks for 2026

Navigating the rental market requires a forward-looking perspective. As your dedicated property partner, we project a period of sustained, moderate growth in rental prices through 2026. This trend is underpinned by robust economic fundamentals and increasing demand for high-quality living spaces. For those seeking an apartment for rent, understanding these future dynamics is key to making a confident and well-timed decision. The market is expected to favour landlords, yet strategic opportunities for tenants will remain.

Average Rental Costs by Property Type

Our analysis indicates specific price trajectories based on property size and amenities. We project that studios and one-bedroom apartments in desirable urban areas will command monthly rents between €800 and €1,200. For larger families, two and three-bedroom apartments are anticipated to range from €1,500 to €2,500, varying by neighbourhood. Expect to see significant premiums for properties with in-demand features, such as:

- Prime Locations: Proximity to business hubs or cultural centres can add 15-20% to the base rent.

- Desirable Views: Sea or landmark views often increase rental costs by up to 25%.

- Premium Amenities: Access to private pools, modern gyms, and concierge services will command higher prices.

Long-Term vs. Short-Term Rental Yields for Investors

For property owners, the choice between long-term and short-term rentals presents a strategic trade-off. Long-term leases offer consistent, stable income and lower tenant turnover, providing a reliable financial foundation. Conversely, short-term holiday lets can generate significantly higher yields, particularly during peak tourist seasons, but come with increased management demands and potential vacancy periods. Your optimal strategy depends entirely on your investment goals and appetite for active management.

Factors That Will Influence Future Prices

Several key developments are poised to shape the rental landscape. The government’s continued focus on Egypt’s economic growth and development is fostering a positive investment climate. Major infrastructure projects, including airport expansions and new transport links, will enhance connectivity and elevate property values in surrounding areas. Furthermore, the establishment of new international schools, hospitals, and commercial centres will create new, desirable residential hubs, driving localized rental demand and price appreciation. Staying informed on these trends is crucial when selecting an apartment for rent for the long term.

In-Demand Features: What Tenants Will Prioritize in 2026

As we look towards 2026, the landscape of tenant expectations is undergoing a significant transformation. The search for an apartment for rent is no longer merely about location and square footage; it is about securing a seamless, integrated lifestyle. Discerning tenants now prioritize properties that cater to a holistic need for connectivity, wellness, and modern convenience. For property owners, understanding this shift is key to making strategic upgrades that attract and retain high-quality residents.

The ‘Work-from-Anywhere’ Apartment

The rise of remote work has made the home a professional hub, and tenant demands reflect this reality. Non-negotiable features now include high-speed, reliable fiber optic internet to ensure uninterrupted productivity. Beyond connectivity, there is a strong preference for dedicated home office spaces or flexible layouts that can accommodate a professional workspace. Proximity to co-working spaces and business-friendly cafes also adds considerable value, offering a change of scenery and networking opportunities.

Lifestyle and Wellness Amenities

Modern tenants seek a living experience that supports their well-being and social life. Properties that offer a curated lifestyle are in high demand. Key features that enhance rental appeal include:

- Access to state-of-the-art fitness centers, swimming pools, and exclusive resident lounges.

- Inclusion within walkable communities with easy access to retail, dining, and green spaces.

- Comprehensive 24/7 security and professional, responsive property management to provide peace of mind.

These amenities are no longer luxuries but foundational elements of a premium living environment.

Smart Homes and Sustainability

Technology and environmental consciousness are increasingly influencing rental decisions. An apartment for rent equipped with smart home technology—such as smart thermostats, keyless entry, and integrated lighting—offers unparalleled convenience and a modern appeal. Furthermore, tenants show a growing preference for properties with sustainable features, including energy-efficient appliances and eco-friendly building materials, which promise lower utility costs and a reduced carbon footprint.

Navigating the Rental Process in Egypt: A Guide for Expatriates

Securing a premium residence in Egypt can be a seamless experience with the right preparation. For expatriates, understanding the local rental landscape is the first step toward finding your ideal home with confidence. This guide demystifies the process of finding an apartment for rent, ensuring you are well-equipped for a successful property search and a smooth transition into your new life.

Essential Documentation and Requirements

To proceed with a rental, landlords and their agents will require specific documentation to verify your identity and financial stability. This is a standard part of the due diligence process and ensures a transparent agreement for both parties. Typically, you will need to provide:

- Valid Passport & Visa: A clear copy of your passport’s photo page and your valid Egyptian residency visa are non-negotiable requirements.

- Proof of Employment: A letter from your employer or a copy of your employment contract may be requested to demonstrate financial standing.

- Professional Verification: Your real estate partner will assist in compiling and presenting these documents, ensuring they meet all local requirements with integrity.

Understanding Your Lease Agreement

The lease agreement, or ‘Aqd Ijar, is a legally binding document. While often in Arabic, a translated version should be reviewed with meticulous care before signing. Pay close attention to these key components to avoid future misunderstandings:

- Lease Duration: Long-term rentals in Egypt typically have a standard one-year term, often with clear clauses regarding renewal.

- Financial Terms: Clarify the security deposit amount (usually one to two months’ rent), the payment schedule, and accepted methods of payment.

- Critical Clauses: Understand your responsibilities for maintenance, utility payments (electricity, water, gas), and the conditions for early termination.

Why Partner with a Real Estate Specialist?

Navigating a foreign property market presents unique challenges, from language barriers to unfamiliar legal norms. Engaging a seasoned real estate specialist transforms this complexity into a streamlined, secure process. A dedicated partner offers more than just listings; they provide curated selections that match your criteria, expert negotiation to secure fair terms, and invaluable guidance through all administrative procedures. This professional oversight ensures your interests are protected at every step. Allow us to be your dedicated partner in finding the perfect rental.

The Buy-to-Let Market: Investment Opportunities in 2026

For sophisticated investors seeking robust returns, Egypt’s Red Sea coast is emerging as a premier buy-to-let market. Its unique combination of year-round sunshine, world-class leisure facilities, and growing international appeal presents a compelling opportunity for generating consistent rental income. As we look towards 2026, strategic asset acquisition in this region can deliver both significant capital appreciation and strong rental yields.

Identifying High-Yield Locations

Success in the buy-to-let market begins with strategic location selection. We advise focusing on areas with proven performance and high-growth potential. Established communities in El Gouna offer a stable investment, with consistent demand from both short-term tourists and long-term residents. For those seeking higher growth, emerging luxury developments in Soma Bay provide an opportunity to enter a market poised for significant appreciation. These locations offer a diverse portfolio, from luxury villas to a high-demand apartment for rent, ensuring year-round appeal.

Calculating Your Potential Rental ROI

A clear understanding of your potential return on investment (ROI) is fundamental. We provide our partners with a transparent framework for financial planning. The essential formula is:

(Annual Rental Income – Annual Operating Costs) / Total Investment Cost = Net Rental Yield

To achieve an accurate financial picture, it is crucial to factor in all key expenses beyond the purchase price. These typically include:

- Community service charges

- Routine maintenance and repairs

- Professional property management fees

Understanding the difference between gross and net yield will empower you to make informed decisions based on the true profitability of your apartment for rent.

Seamless Property Management from Abroad

For international investors, effective property management is the key to a successful and stress-free experience. A dedicated management partner provides complete peace of mind by handling every operational detail, from meticulous tenant screening and communication to ensuring timely rent collection. Professional oversight of property maintenance protects your asset’s value and ensures it remains in pristine condition.

At Liaison Property, our mission is to make your investment journey seamless. We act as your trusted representative on the ground, allowing you to enjoy the benefits of ownership without the day-to-day complexities. Explore our property management services for your investment.

Secure Your Red Sea Future: Partnering for Success in 2026

As we look toward 2026, Egypt’s Red Sea property landscape presents a dynamic and promising future. Key market indicators point to sustained rental price growth, particularly for properties that meet evolving tenant demands for modern amenities and prime locations. For both expatriates seeking a new home and investors targeting high-yield opportunities, understanding these trends is crucial for success. Whether you are searching for the perfect luxury apartment for rent or aiming to capitalize on the robust buy-to-let market, having a trusted partner is paramount to navigating this sophisticated environment.

At Liaison Property, we provide this essential partnership. Our unrivaled expertise in the El Gouna and Soma Bay luxury markets, combined with a seamless, transparent rental process for international clients and dedicated advisory for investors, ensures your objectives are met with precision and integrity. Discover premier apartments for rent with your trusted Red Sea property partner.

Let us help you navigate the promising horizon of the Red Sea with confidence. Your ideal property awaits.

Frequently Asked Questions

What is the typical difference between furnished and unfurnished apartments in the Red Sea?

A furnished apartment for rent in the Red Sea is typically “turnkey,” equipped with all essential furniture, major appliances, air conditioning, and often kitchenware, offering immediate convenience. In contrast, an unfurnished apartment provides a blank canvas, frequently lacking even basic fixtures like kitchen cabinets or AC units. This option allows for complete personalization but requires a significant initial investment and is better suited for those planning a long-term residence.

Are utilities like electricity, water, and internet usually included in the monthly rent?

In most rental agreements in Egypt, utilities are not included in the monthly rent. Tenants are typically responsible for electricity and water consumption, which is often managed through a prepaid card system. Internet and satellite television services also require a separate subscription established directly by the tenant. To ensure full transparency, it is essential to clarify these responsibilities with the landlord or your property partner before signing the lease agreement.

How much is the standard security deposit for a long-term rental in Egypt?

The standard security deposit for a long-term rental is typically equivalent to one or two months’ rent. This deposit is held by the landlord as a guarantee against potential damages to the property beyond normal wear and tear. At the end of the lease term, this amount is fully refundable, provided the apartment is returned in its original condition. A detailed inventory check-in and check-out process is crucial to ensure a seamless and fair return.

Is it common to negotiate the rental price with landlords in El Gouna or Soma Bay?

Negotiating the rental price is a common and accepted practice in the Red Sea property market, including in premier locations like El Gouna and Soma Bay. While there is often room for discussion, the potential for negotiation typically increases with the length of the proposed lease. Engaging with a seasoned property professional can provide the strategic guidance needed to approach these negotiations with confidence, ensuring you secure the most favorable terms for your chosen residence.

What are the basic legal rights and responsibilities of a tenant in Egypt?

A tenant’s fundamental rights in Egypt include the right to quiet enjoyment of the property and the assurance that it is maintained in a habitable condition by the landlord. Key responsibilities include paying rent punctually, maintaining the property well, and not making unauthorized alterations or subletting without explicit permission. A clearly drafted lease agreement is paramount to protecting both parties and ensuring a transparent landlord-tenant relationship throughout the tenancy.

Can I rent an apartment if I am in Egypt on a tourist visa?

While it is possible to secure a short-term rental on a tourist visa, most landlords require proof of a valid residency permit for long-term leases of six months or more. This provides the landlord with a necessary level of security and assurance regarding the tenancy. For those seeking a long-term commitment, we recommend initiating the residency application process in parallel with your property search to ensure a seamless transition into your new home.